If you already own your home, you’re probably familiar (maybe far too familiar) with what it takes to maintain your home. From regular upkeep to occasional upgrades to the dreaded unexpected emergency repair, being a homeowner means always staying on top of the ever-changing condition of your home. The same is true for your home mortgage. While your rate, loan program, and monthly payment may have been a good fit for you when you first took out your mortgage, the market is constantly shifting, and your financial goals could change. Mortgage experts will generally recommend a mortgage health review with your loan officer at least once a year to ensure you’re still on track to meet your goals and to determine if there may be better options available to you. Depending on your circumstances and goals, refinancing may be the right option for you.

What is Refinancing?

A refinance is the process in which a homeowner pays off and replaces their old mortgage with a new mortgage to achieve either lower rates, a lower monthly payment, or other favorable changes to their mortgage. When you refinance, you’ll work with a lender (either the same lender who provided your original mortgage or a different lender, the choice is yours) and move through a similar loan application process to when you purchased your home. You will still need to provide financial documents to your lender and have your credit pulled for review. Your loan application will then go through the same milestones to be reviewed and approved. We will go into more depth on the milestones in the refinancing and home buying process in the “The Digital Online Refinancing Process” section below. Once your new loan is approved, it will be used to pay off your existing loan, replacing it as your new mortgage.

Reasons to Refinance

Homeowners will have varying reasons to refinance depending on their financial situation and home financing goals. Those who are interested in refinancing may be looking to:

Get a Lower Rate

Refinancing for a lower rate is the most popular reason homeowners refinance. When market adjustments cause interest rates to drop, it may be a good idea to reach out to your loan officer to find out what kind of rates they can offer you for a refinance. Mortgage experts say it’s usually advisable to refinance for a lower rate if you can snatch a rate that is 2% lower than your current rate, although even a reduction by only 0.50% - 1% could be worth it.

When you get a lower rate with a refinance, you’ll save money by spending less of your monthly mortgage payments on interest, reducing your monthly payment amount overall, and building equity in your home quicker.

Lower Monthly Payments

As mentioned above, when you refinance for a lower rate, in most cases your monthly payment amount will drop as well. Many homeowners see their payments reduce by a few hundred dollars per month when they refinance.

Shorten the Mortgage Term

When you refinance your mortgage, you may want to opt for a shorter loan term. For example, let's say your original mortgage was a 30-year loan with a higher interest rate. Since then you may have switched jobs or been promoted, resulting in higher income and a desire to use that income to build more equity in your home. If interest rates are low and your qualifications have remained strong, it may be a good idea to refinance for a 15-year loan term with a lower interest rate. While your monthly payments will increase, a bulk of those payments will be going to building equity in your home instead of paying down interest.

Adjust Rate Type

Let’s quickly review the types of mortgage rates before we dive into this topic:

- Adjustable-rate mortgage: a rate that is not fixed and changes throughout the life of the loan based on an index. These rates usually begin lower but can rise over time.

- Fixed-rate mortgage: a rate that is fixed and does not change throughout the life of the loan.

When you refinance, if you previously had an adjustable-rate mortgage, you can opt for a fixed-rate mortgage this time, or vice versa. Depending on your goals, and how long you plan to stay in the home, this can play a major role when choosing a fixed-rate mortgage or an adjustable-rate mortgage.

Access Equity to Take Cash Out

Another popular reason to refinance is to access your equity to take cash out. This could be a good option for you if you need to access a significant amount of cash for a home repair, remodel, or financial emergency. It's important to discuss this strategy with your loan officer to ensure that pulling cash out of your home is the right financial move for you.

Whatever reason you have for refinancing, it’s important to take the time and consider everything that comes along with making that financial decision. Refinancing is accompanied by fees so you will want to consider if the savings you will receive from refinancing is worth the cost of both your time and money. Your loan officer can help you consider the ins and outs of refinancing and the total costs associated when you meet with them for your yearly mortgage health check.

The Digital Online Refinance Process

The digital refinancing process is very similar to the traditional homebuying or refinancing process, it just takes place from your computer, smart phone, or tablet and utilizes automation to move you through the loan process.

- You’ll begin the refinancing process by completing the online mortgage application. The Warp Speed Mortgage smart application will request basic information needed to determine your loan qualifications, quickly reviewing your submissions, and requesting more documentation if needed.

- While you’re completing your online mortgage application, you will be prompted to upload financial documents for Underwriting review. This can be done quickly and easily through digital asset verification tools that communicate directly with your financial institutions to securely verify assets and collect necessary documents. You may be asked to upload documents more than once depending on your application.

- At this stage you will also choose your rate and loan program from personalized options based on your financing goals.

- Once your documentation has been collected and your loan program and rates have been selected, your application is digitally sent to your Client Manager to do an initial review. Once they have determined enough information has been collected, they will send your loan to Underwriting to begin its journey through the loan process.

- When your loan completes the first round of Underwriting, it will move to the Processing stage of the loan process where your Client Manager will review your loan file once again and request any additional documentation. Your loan will then move to the final Underwriting stage to prepare to be approved.

- Once your loan is approved, documents are signed during your eClosing. The eClosing process is very similar to the traditional closing process, you’ll simply be signing some or all closing documents (depending on your type of eClosing) digitally instead of with paper and ink. You’ll choose how and where you eClose.

Underwriting First

The Warp Speed Mortgage home loan process is slightly different from other lenders. Once your application is completed, your Client Manager will review your application for any additional documents and then pass your application on to the Underwriting Team to complete the Initial Underwriting milestone. During this milestone, the Underwriting Team will review your home loan application and determine if all needed documentation and information is available to move on to the next milestone. It's not common for a mortgage company to get their Underwriting Team involved so early in the process, but we've found that it makes the entire process faster; it's become our secret sauce to fast home loan closes!

Processing Milestone

Once your loan reaches the Processing milestone, smart technology will review your application and add any new conditions, or additional document or information requests, that may need to be satisfied based on your specific loan program and financial situation. You and your Client Manager will start working on clearing any conditions identified by the Underwriting Team.

Final Underwriting

Final Underwriting is the last milestone before your loan is ready to fund. You’ll receive a message in your communication portal from your Client Manager that goes over any new conditions that may have been added during the Processing milestone. You’ll easily be able to upload this information directly to the Underwriting Team yourself from your Warp Speed Portal, but your Client Manager can also work with you to acquire whatever might be needed.

When you move forward to the next milestone in the loan process is up to you – the quicker you’re able to upload your additional documents, the better! Once the documentation is uploaded, your loan file will be reviewed one last time by your Client Manager to review for final approval. Your Client Manager will schedule a call with you to go over your loan details and schedule your loan closing. You’ll be able to choose from eClosing options (not available in all states) that can turn your loan closing into a remote process that takes place from your home.

eClosing

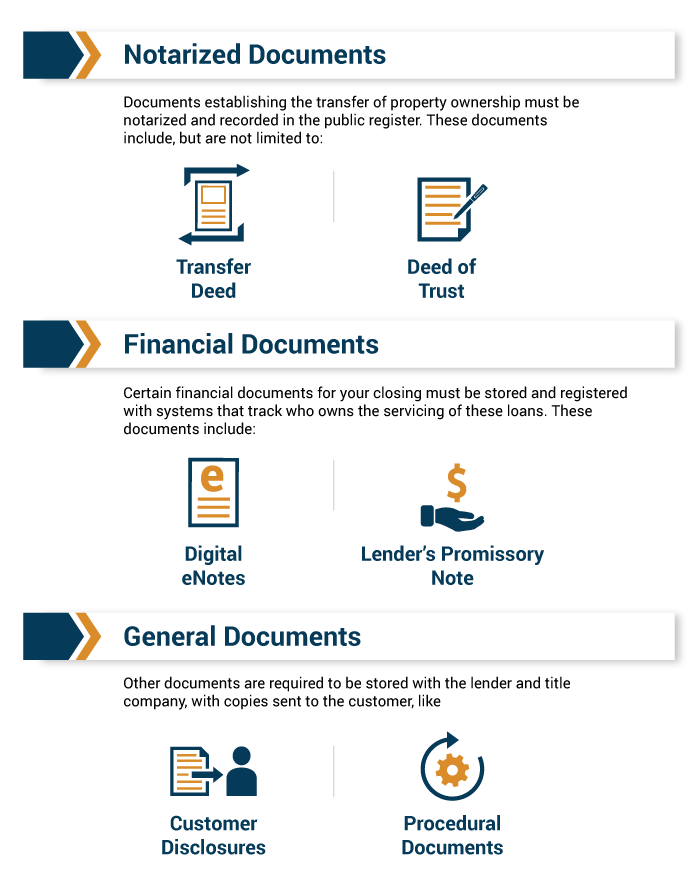

During your eClosing process, you’ll sign the following loan documents either digitally or in person, depending on the type of closing you chose:

Once all your documents are signed, you’ll have a final call with your Client Manager to go over final details and officially close your loan. It’s official! You’ve refinanced your home loan!

Yearly Mortgage Health Checks

A reputable loan officer will remain invested in your home financing goals well after your loan closes. In fact, you may have already had your loan officer reach out to you about scheduling a mortgage health check.

During a mortgage health check, your loan officer will analyze your loan as it stands currently and discuss your financing goals with you as they may have changed since the last time you spoke. If rates have dropped dramatically or if switching to a fixed-rate mortgage would be advisable, your loan officer may suggest that you refinance. If you have a need to pull cash out, your loan officer will go over all the details with you and help you decide if going that route would be beneficial to you.

Your loan officer is your personal mortgage expert, and any reputable loan officer’s goal is to ensure that you can reach your home financing goals. If you aren’t sure about whether or not refinancing is right for you, your loan officer is there to help.

Refinancing can be a fantastic option for homeowners who are looking for a lower interest rate or to adjust the terms of their mortgage. While it is possible to refinance to take cash out, it’s best to discuss this option with a reputable loan officer in detail to ensure it’s the right move for you. If you’re ready to begin the process to refinance, get started here!