If you’re looking to achieve your home financing goals, you know a big part of the process is the closing experience, or the process where you sign all your documents to finalize your loan – some, all, or none of which can be done remotely (state restrictions do apply). There are several types of closing processes, from the traditional, in-person process your parents are probably familiar with, to a completely remote experience that finally brings mortgage into the 21st century; which one you choose will be determined by your preference and your state of residence. Today we are going to specifically discuss eClosings, or electronic closings, which are closings that include documents sent electronically and signed with a digital signature.

Types of eClosings

There are several types of eClosings, and which you choose to move forward with depends on your personal preference, comfort using digital technology, and the state you reside in. If eClosing doesn’t sound right for you, the traditional closing process is always an available option.

- Traditional Closing: This is the standard way people have been conducting mortgage closings since the pre-internet age. In person, with a notary present, and traditional ID verification.

- Hybrid eClosing: Hybrid eClosings will allow you to sign some documents digitally, like procedural documents and disclosures, while other documents, like the Transfer Deed or Promissory Note, will be signed in-person with traditional ID verification and a notary present.

- In-Person eClosing: In-Person eClosings mean that you will sign all closing documents digitally, from a laptop or tablet, but will still require notary be present and traditional ID verification.

- Remote Notary eClosing: Remote Notary eClosings can be conducted from any location* and are completely online. You’ll sign all documents digitally from a computer or tablet and have a notary present via webcam. This type of eClosing does require a digital ID verification.

What is digital ID verification and how does it work?

Digital ID verification confirms you are who you say you are by comparing an uploaded image of an ID like a government issued driver’s license or passport with a government database. Automated technology analyzes the uploaded image, scanning for different authentication features, and verifies your identity in seconds.

Notaries

It’s important to keep in mind that all types of remote notaries are not available in all states. The type of notary dictates how the notary observes the signing of your closing documents and confirms your identity, and how you sign the documents for signature.

- Remote Online Notary (RON): completely online remote notarization of electronic documents using digital ID verification.

- Paper Remote Online Notarization (PRON): remote online notarization of physical documents (delivered via mail) using digital ID verification.

- Remote Ink Notarization (RIN): remote notarization of physical documents (delivered via mail) through an audio-visual communication platform like Skype or Facetime.

- Traditional Wet Ink Notarization (TWIN): the traditional notarization process – an in person signing on physical documents.

- In Person Electronic Notarization (IPEN): In person notarization of electronic documents with a digital signature.

eSignatures

During the eClosing process, you will need to sign your documents using an eSignature, of which there are several types. While these types of eSignatures are all effective, you may find one easier depending on the tools you have available to you.

- Wet ink: A wet ink signature is a signature physically made on a piece of paper with a pen. In the event that you use a wet signature for your eClosing, you will need to scan the document to your computer to be sent digitally.

- Plain text: A plain text signature is when you simply type in your name on the signature line of a document with a standard Serif or Sans Serif font type.

- Script font: A script font signature is when you type in your name on the signature line of a document using a script font type, or a cursive-style font type that distinguishes your signature from the rest of the text on the document.

- Digital capture: A digital capture signature is when you use your finger or a stylus to physically sign your name on a document displayed on a tablet or laptop with touch-screen capability.

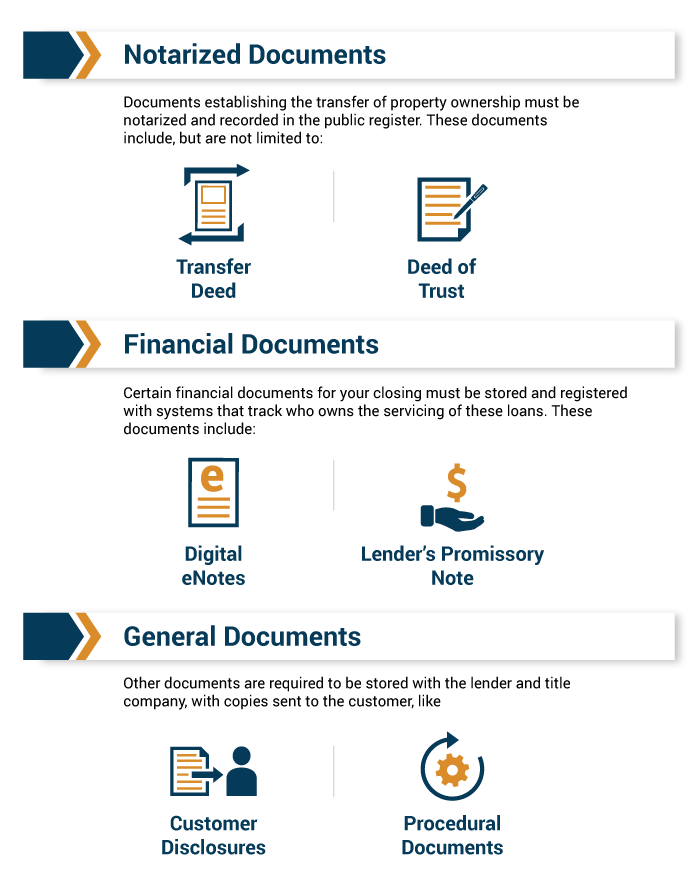

Which documents do I sign during the closing process?

No matter which type of closing you choose, you will be signing the following documents. Whether the documents are signed digitally or in-person will depend on which closing process you choose – ask your Loan Officer for more information about your specific closing.

eClosing: Is it right for you?

While eClosings were introduced to make the closing process easier and less stressful for borrowers, it’s not something that will work for everyone. Let’s meet Darla and Steven and decide which closing process might be best for them.

Meet Darla…

Darla lives in Nevada and has bought a home before, in fact this is her fifth time going through the whole process. Darla is a Baby Boomer, born in 1954, and feels very familiar with the home loan process. She doesn’t have a desire to mix things up and change the way things have been done since her first home purchase back in 1978. Darla also doesn’t love using computers – she started this home loan process by calling the same loan officer she’s had a relationship with for years. While Darla’s state does accept Remote Notary eClosing, her lack of familiarity with digital technology and level of comfort with the traditional home loan process means that a traditional closing would be the right choice for her.

Meet Steven…

Steven lives in Colorado and is a first-time homebuyer. He’s a millennial who was born in 1989 and he’s finally in the financial position to buy a home with his wife. Both him and his wife are white collar professionals who use computers every single day at work, as well as recreationally at home. Steven plays video games online with his friends, video chats regularly with family across the country, and almost exclusively shops online. The idea of an in-person mortgage experience is off-putting to him, he likes to get things done quickly, online, and on his own time. Steven and his wife found their loan officer through and online search and word of mouth and completed their application online before ever speaking to the loan officer. Because of Steven’s familiarity with digital technology and his desire to work on his own time, the eClosing option that is available in his state would be the best option for him and his wife.