Whether you’re a first-time homebuyer or preparing to make the move from your starter home to your forever home, it’s important to know the ins and outs of the home buying process and your program options. While the mortgage process can be overwhelming to some, our goal is to ensure that you have a full understanding and a reliable roadmap for your home buying journey.

Getting Pre-Approved

Once you’re ready to begin the process of buying a home, the first thing you will want to do is get pre-approved. A pre-approval is letter from your lender that contains a definitive assessment of your purchasing power and outlines the amount you are qualified to borrow along with other important information. It will also give you a better idea of the interest rate you qualify for.

To get pre-approved, you’ll complete a mortgage application and provide documentation to your lender, who will review the documents, pull your credit, and assess your current financial situation. They will then supply a pre-approval letter which you will use to let sellers know that you have been approved to borrow an amount up to or exceeding the listing price of their home. If you've been unsuccessful at getting pre-approved in the past, there are steps you can take to better your chances of a successful pre-approval next time.

Looking to buy a home?

Now that you have your pre-approval in hand, it will act as your advocate when making an offer on a home. A strong pre-approval can set you apart from other buyers, especially those who only have a pre-qualification to go along with their offer. When you’re buying in a competitive seller’s market, your pre-approval shows that you’ve already begun the home financing process with your lender and will likely be able to complete the process quicker than other potential buyers.

Before we move on to talk more about the digital online mortgage application, you may be wondering what the difference is between a pre-approval and a pre-qualification. While a pre-approval is a definitive assessment of your purchasing power based on information that has been reviewed and verified by your lender, a pre-qualification is an estimate of your purchasing power based on information that you provide to the lender but has not been verified. Simply put, a pre-approval is a stronger, more conclusive statement of your purchasing power that a seller can see as more reliable.

The Online Application

The digital online mortgage application is a big part of the pre-approval process and the home financing process altogether. Here is where all the initial information that your lender will need to assess you for pre-approval and get you started on your home financing journey is collected. The Warp Speed Mortgage online application is an easy-to-use digital form that can be completed from your computer, smart phone, or tablet.

You’ll start by selecting your financing goal. Then, you’ll be prompted to complete your profile with your personal, financial, and demographic information. Once you have filled out your profile, you’ll be able to view and select your loan programs and rates from a personalized selection based on your application responses. You’ll then be asked to upload your financial documents to officially submit your application and begin the loan process (you may be asked to upload documents more than once depending on your application). Typically, the following documentation is requested:

- Paystubs covering the last 30-day period

- W-2’s and/or 1099’s from the most recent 2-year period

- Tax returns from the most recent 2-year period (include personal and business if applicable)

- Bank statements: Most recent 2 months (all pages)

- Retirement/Investment Accounts: Most recent 2 months' statements or most recent quarterly (all pages)

- ID verification

- For property owners: Each property owned, your most recent mortgage statement, homeowner’s insurance declaration page, income taxes, and HOA statement

The above documentation can be gathered quickly and easily through digital asset verification tools that communicate directly with your financial institutions to securely verify assets and collect necessary documents. As you move through the application, smart technology reads your application and determines additional needed items, eligibilities, next steps, and will raise flags for any questions that arise. Once the application is completed and all necessary documentation is collected, you will be assigned a dedicated Client Manager and your loan will begin moving through the home financing process!

Underwriting First

The Warp Speed Mortgage home loan process is slightly different from other lenders. Once your application is completed, your Client Manager will review your application for any additional documents and then pass your application on to the Underwriting Team to complete the Initial Underwriting milestone. During this stage, the Underwriting Team will review your home loan application and determine if all needed documentation and information is available to move on to the next stage. It's not common for a mortgage company to get their Underwriting Team involved so early in the process, but we've found that it makes the entire process faster; it's become our secret sauce to fast home loan closes!

Processing Stage

Once your loan reaches the Processing stage, smart technology will review your application and add any new conditions, or additional document or information requests, that may need to be satisfied based on your specific loan program and financial situation. You and your Client Manager will start working on clearing any conditions identified by the Underwriting Team.

Final Underwriting

Final Underwriting is the last stage before your loan is ready to fund. You’ll receive a message in your communication portal from your Client Manager that goes over any new conditions that may have been added during the Processing stage. You’ll easily be able to upload this information directly to the Underwriting team yourself from your Warp Speed Portal, buy your Client Manager will also work with you to acquire what is needed if necessary.

When you move forward to the next stage in the process is up to you – the quicker you’re able to upload your additional documents, the better! Once the documentation is uploaded, your loan file will be reviewed one last time before being passed to your Client Manager to review for final approval and schedule a call with you to go over your loan and schedule your closing. You’ll be able to choose from eClosing options (not available in all states) that can turn your closing into a remote process that takes place from your home.

eClosing

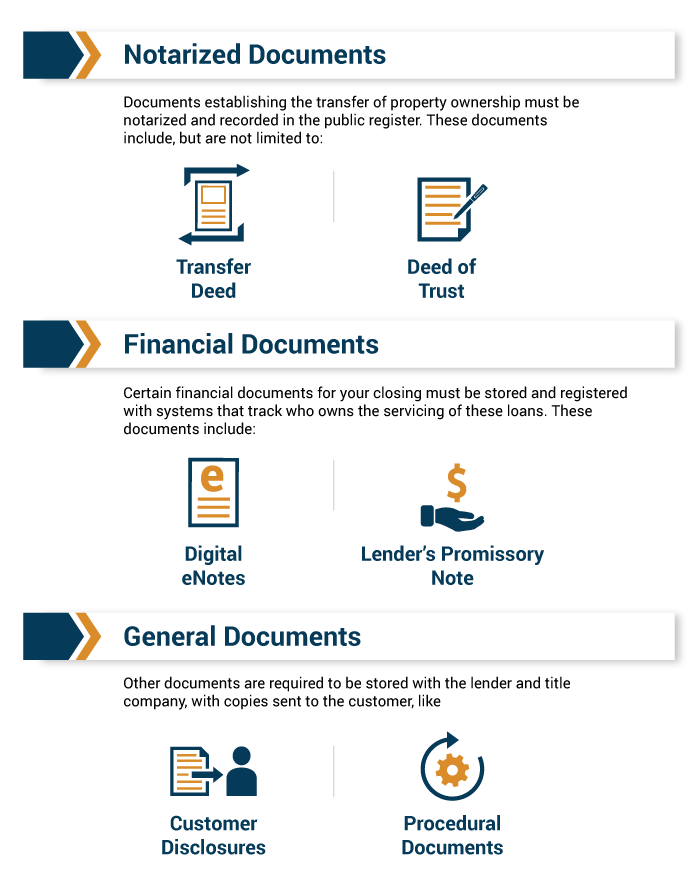

During your eClosing process, you’ll sign the following loan documents either digitally or in person, depending on the type of closing you chose:

Once all your documents are signed, you’ll have a final call with your Client Manager to go over final details and officially close your loan. It’s official! You’re the owner of a new home!

Available Loan Programs

When you use Warp Speed Mortgage, you can choose from a wide variety of traditional and portfolio home loan options that best fit your home financing goals, including:

Buying a home is one of the largest purchases you’ll make in your life, so it’s important to be educated on the process and what to expect before you dive in! The Warp Speed Mortgage digital online process allows you to buy the home of your dreams at your own pace from the comfort of your home. You’ll also have access to mortgage experts that can answer any questions that may arise throughout your home buying journey. If you’re ready to begin, get started today!