Are you caught in the “waiting game” when it comes to interest rates and housing prices? It’s time to break free from the myth and make informed decisions based on historical evidence.

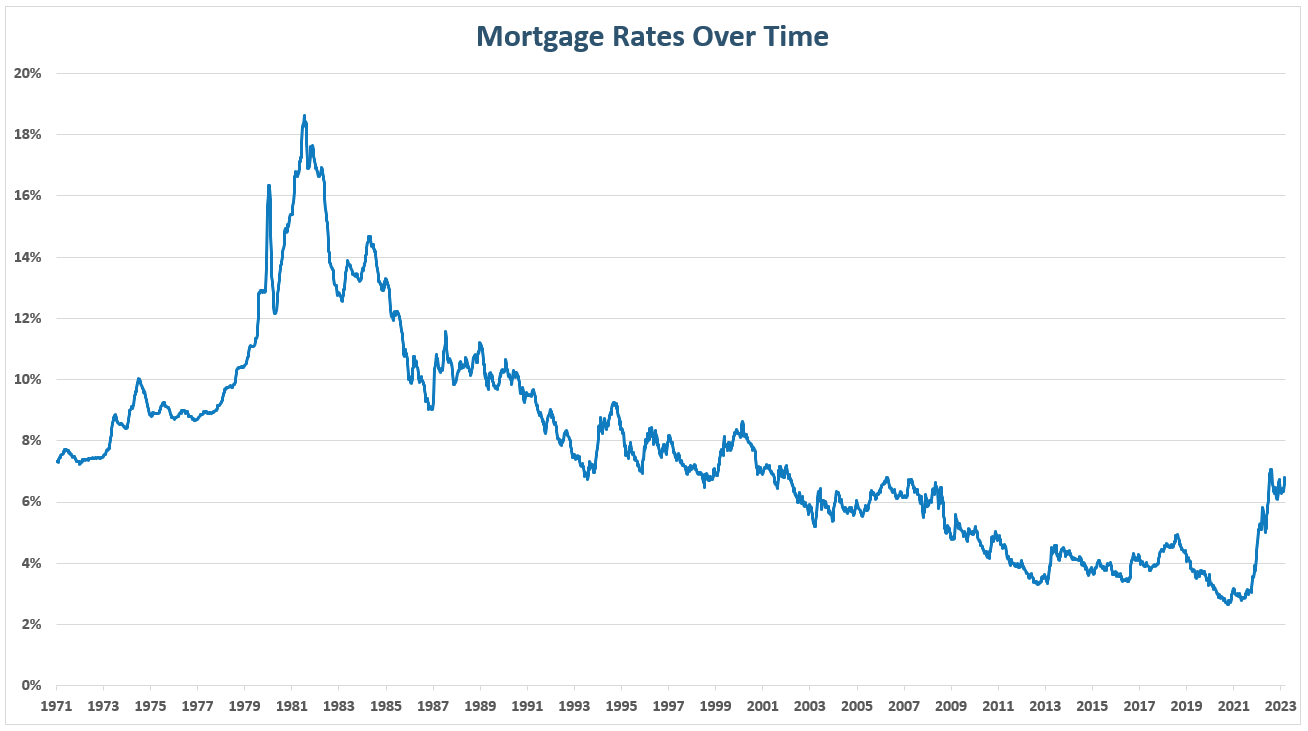

Interest Rates: Looking at the Bigger Picture

When you look at interest rates in the last 5-10 years, you may wonder if it makes sense to wait for rates to drop to historic lows again before buying a home. However, savvy homebuyers look at the bigger picture and find that when you zoom out and analyze the historical trends of interest rates since the 1970’s, the cost to borrow today is still below average.

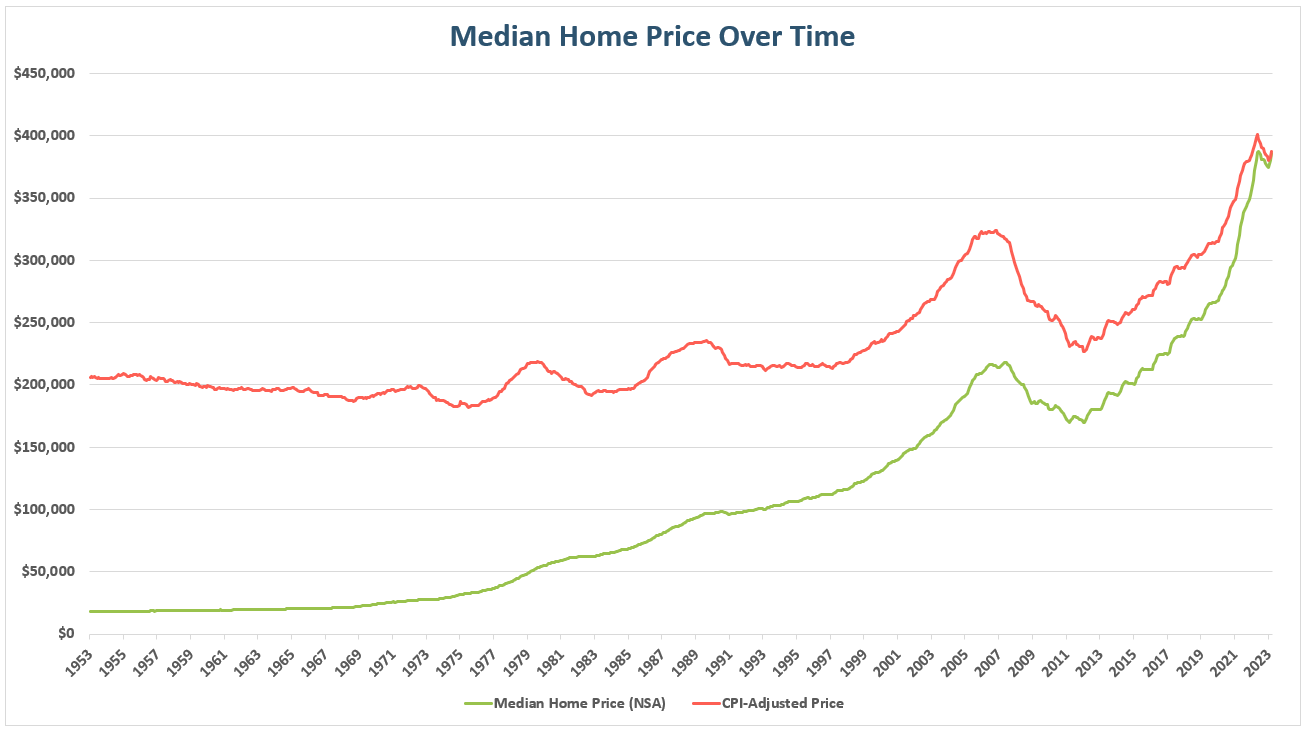

Housing Prices Almost Always Increase Over Time

There’s a reason real estate has a reputation of being a reliable investment – housing prices generally trend upward over time. Especially in today’s housing market of low inventory and high demand, your dream home’s asking price is likely lower today than it will be a year from now.

While you may see small fluctuations in interest rates and housing prices, historical trends show us that playing the waiting game can hurt more than it can help. If you are financially ready, there is no better time than the present to start the process to buy your dream home! Get started now by viewing today’s mortgage rates!