When you’re ready to begin your home financing journey, the first thing you’ll want to consider is whether you qualify for a home loan in your current financial situation. While it can vary by loan type, all home loans have minimum credit score, down payment, debt-to-income, and mortgage insurance requirements. These requirements are in place to ensure that home buyers, in an effort to buy the home of their dreams, don’t end up with a mortgage that they may not be able to afford down the line.

Credit Score

Your credit score is a numerical value, ranging from 300 to 850, that represents your creditworthiness to lenders or businesses you may want to work with. A higher credit score tells lenders that you are a reliable person to lend to and can translate to more favorable rate offerings. You may be wondering how important credit score is when it comes to applying for a mortgage. There’s no way around it: your credit score plays a major role in determining your home loan qualifications.

When you submit a mortgage application, the lender will “pull your credit”, meaning they request a credit report from the three major credit bureaus: Equifax, Experion, and TransUnion. When a mortgage lender pulls your credit, it is considered a “hard” inquiry, which can have a slight negative affect on your credit score. However, because credit bureaus know that you’re likely to have your credit pulled more than once during the home buying process, any credit pulls from a mortgage lender within a 45-day period only register as one hard inquiry on your credit report.

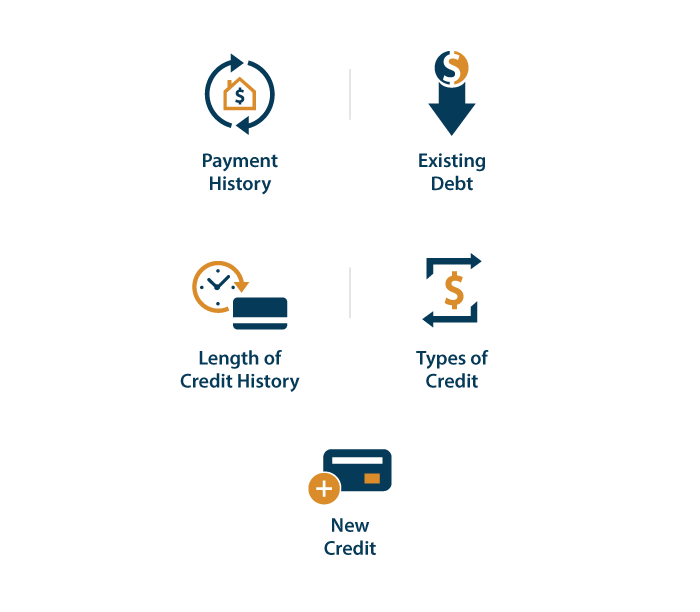

There are a few different factors that go into determining your credit score

- Payment history: This is the most significant consideration to your credit score. While you likely won’t see an effect on your credit score if you make a payment one or two days late, missing a payment by thirty days or more can cause your credit score to drop. From a lender’s perspective, someone who is prone to making late payments often is likely unable to handle additional debt obligations. For this reason, it’s important to stay on top of all your financial obligations, as even a small unpaid debt can cause noticeable dips in your score.

- Existing Debt: The amount of debt you have is also a major consideration for your credit score, however this isn’t a cut and dry consideration. Having more debt isn’t necessarily a red flag to creditors, but rather your debt amount is considered alongside your payment history and the amount of revolving debt you keep compared to your credit limit. Reducing the amount of revolving debt you keep on your credit accounts can help improve your credit score.

- Length of credit history: While not as significant of a factor than the above mentioned, the length of your credit history does play a part in determining your credit score. The longer the history, the more information credit bureaus have to base your score off of. This is why it is so important not to close credit card accounts, especially your really old ones! Closing an old credit card account can significantly impact your credit score as you would essentially be erasing an entire time period of your credit history.

- Types of credit: This is a determination of the different types of credit you hold, such as car loans, credit cards, student loans, etc and plays a small part in your credit score.

- New credit: How many new credit accounts have you opened and applied for recently? This is also a small consideration for your credit score.

It’s also important to know what credit score is considered a “good” score or a “bad” score. The mortgage industry generally follows the below basic categorization, although it can vary slightly by lender. Keep in mind that minimum qualifying credit scores vary by lender and loan program, however generally speaking, if you have what is considered a “poor” score, it may be advisable to work on improving your score before applying for a mortgage.

A credit score of 740 or higher is considered Excellent.

A credit score between 700 and 739 is considered Good.

A credit score between 630 and 699 is considered Fair.

A credit score below 629 is considered Poor.

If your credit score is lower than you would like, there are steps you can take to improve your credit score. These steps take time but can prove beneficial when you next apply for a mortgage.

Down payment

A down payment is the upfront amount you pay to purchase a new home and is usually referred to as a percentage of the total purchase price. The down payment is your initial equity in your home. Your lender will then provide the remaining amount to purchase the home. While a down payment is required for most loan programs, there are options that only require a small down payment or even no down payment at all. You can also use a cash gift from a family member or friend as part of your down payment, however you’ll need to prove that the gift has no expectation to be paid back with something called a “gift letter”.

However, the best advice out there is to save up as much as you can for your down payment. A larger down payment can positively reflect on your loan with lower interest rates, less fees, a lower monthly payment, and more equity in your home right away. Reducing the amount that the lender has to lend out for you to purchase your home means that the loan is less risky to them, which results in financial benefits for you. If you have a smaller down payment, less than 20%, you will pay for the increased risk on your loan through additional fees or private mortgage insurance.

Since saving up for a larger down payment can take some time, depending on your situation, it may be better to pursue a loan program that has a lower down payment minimum. If you would like to determine your optimal down payment amount, a mortgage calculator is the best tool to help you plan for your financial situation.

Debt-to-Income Ratio

Your debt-to-income ratio, or DTI, is determined by the amount of your gross monthly income that is allocated to debt payments each month. This ratio is expressed as a percentage, and generally the lower the percentage, the better, as it indicates that a larger proportion of your income is not wrapped up in debt payments. Debt-to-income doesn’t take into consideration the type of debt that you’re carrying, or the interest rates associated with them. Rather, the percentage is calculated using basic arithmetic where the total of your monthly debt payments is divided by your gross monthly income.

An ideal DTI is less than 36% and most lenders will not lend to someone with a DTI that is higher than 43%. This means that preferably you want to keep your debt payments to around 1/3 of your monthly income.

Another metric that is considered along with the DTI is your credit utilization, or debt-to-limit, ratio. This ratio, while similar to DTI, is a measure of how much of your total available credit is currently being used. In essence, this is the way your lender can know if you’re maxing out all your credit cards every month. So, while debt-to-income measures your monthly debt payments as compared to your gross monthly income, debt-to-limit measures your debt balances as compared to your credit limit.

Income

Income is probably one of the most obvious factors a lender must consider when determining whether to lend to a customer. Naturally, a lender wants to ensure that you will have the income in the future to be able to pay the loan back and usually are looking for proof of at least two years of stable income without any gaps. However, means of income can differ from person to person, and not everyone can easily prove their income with a few easy-to-obtain documents.

The most common way that lenders will ask you to prove your income is by requesting some documentation from you, including your:

- Two most recent paystubs

- Two years of W-2s

- Two years of tax returns

If you’re self-employed and can’t prove income using the above listed documents, lenders will also look at a two-year profit-and-loss statement for your business and will determine your monthly income by taking your average income over the past two years and dividing by 24.

Assets

Yet another way a lender will assess your risk is by verifying your assets. In order to do this there are additional documentation requirements on top of your income verification. You’ll do this by providing an asset statement that outlines both the liquid and non-liquid assets in your portfolio. This will usually require gathering a lot of financial documents like your checking and saving account statements, investment and retirement account statements, brokerage statements, etc.

Digital asset verification tools make gathering this documentation easy. When you use a secure digital asset verification platform, you can share your account information from any financial institution with your lender in the form of an asset report in four easy steps.

- Simply select the financial institutions with accounts you would like to have verified.

- Use your online banking credentials to log in to your online banking portal.

- Select which accounts to share with your lender.

- Send your asset report to your lender in a read-only format through encrypted messaging.

Private Mortgage Insurance (PMI)

We mentioned private mortgage insurance, or PMI, previously, so let’s dig into exactly what it is and when it’s needed. Private mortgage insurance is typically required by your lender when your down payment on a conventional loan is less than 20% of the purchase price and is usually paid as an additional fee in addition to your monthly payment but can also be paid as a one-time sum at closing. Because lenders see a loan with less than 20% down as a riskier transaction, PMI is required in these cases to protect the lender in the event you default on your mortgage in the future. While PMI is only applicable to conventional loans, other loan programs do have their own versions of mortgage insurance.

The amount you pay in PMI can range between 0.5% and 1% of your loan amount annually. As you can imagine, a fee like that, split into monthly payments, can add a significant amount to your monthly mortgage bill. For this reason, it’s usually advisable that, if you can, you should try to put down the 20% down payment necessary to avoid private mortgage insurance. However, for many home buyers, especially first-time home buyers, saving up for a 20% down payment can be extremely difficult, making PMI a necessity to achieving their home financing dreams. However, you can cancel your private mortgage insurance once you reach 20% equity in your home, so you won’t be stuck with that extra fee forever!

The Mortgage Do's and Don'ts

Before you begin the mortgage process or while you’re in the middle of applying for a mortgage, there are certain do’s and don’ts you should be aware of to avoid any unnecessary red flags that could jeopardize your loan when your income and assets are being verified.

DON’T

- Change your job, job title, salary, compensation structure, or employer. This information needs to be verified by the lender and changes could result in not qualifying for your loan.

- Make any large purchases like a new car, boat, or appliances until after your loan has funded as this could affect your DTI and/or credit score.

- Make large deposits into your bank account or switch bank accounts.

- Apply for a new credit card or give your information to someone who may run your credit. This could impact your credit score.

- Close credit card accounts as this could increase your debt-to-limit ratio.

DO

- Create a file and keep copies of all your important financial documents including check stubs, W-2s, tax returns, bank and investment account statements, rental agreements, etc.

- Save up and set money aside for your down payment. Or if you are receiving gifts to go towards your down payment, talk to your mortgage professional about how to handle.

- Stay current on existing accounts – one 30-day notice can cost you!

- Continue to use your credit as normal - changing your pattern may raise a red flag and negatively impact your credit score.

- Keep your credit card balances 30% below their limit during the loan process. If you pay down balances, do it across the board.