When you use Warp Speed Mortgage to help you reach your home financing goals, you’re utilizing the power of a digital online mortgage platform that allows you to select your loan program and mortgage rates while moving through the loan process on your own time. The mortgage rates and loan programs that you’re offered are determined by market factors, your qualifications as a borrower, and your desired loan and property details. Discount points can also be used to lower your interest rate.

Market Factors

The specific mortgage rates you are offered depend on your personal loan qualifications as well as market factors that can change day-to-day. The following market factors will impact the rates you’re offered:

- Inflation

- Federal Reserve policy

- Housing market demand

- The bond market

Borrower Qualifications

Your qualifications as a borrower will play one of the biggest roles in determining what mortgage rates you will be offered. Some of the most significant borrower qualifications that are taken into consideration are:

- Credit score

- Employment history

- Debt-to-income ratio

Loan and Property Details

Your desired loan and property will also impact your mortgage rates. The following categories will be taken into consideration and can impact your mortgage rates:

- Property Type: The general rule of thumb is that the more shared walls on your property, the riskier the investment is to lenders. You’ll usually find you’ll be offered lower rates for single family homes and PUDs as compared to condominiums, duplexes, or townhomes.

- Property Usage or Occupation: Typically, you’ll be offered lower rates for primary residences as compared to second homes or investment properties.

- Home location: Rates can vary by state and even county in some cases.

- Loan amount

- Down payment amount

- Loan type

- Interest rate type

- Loan term

Discount Points

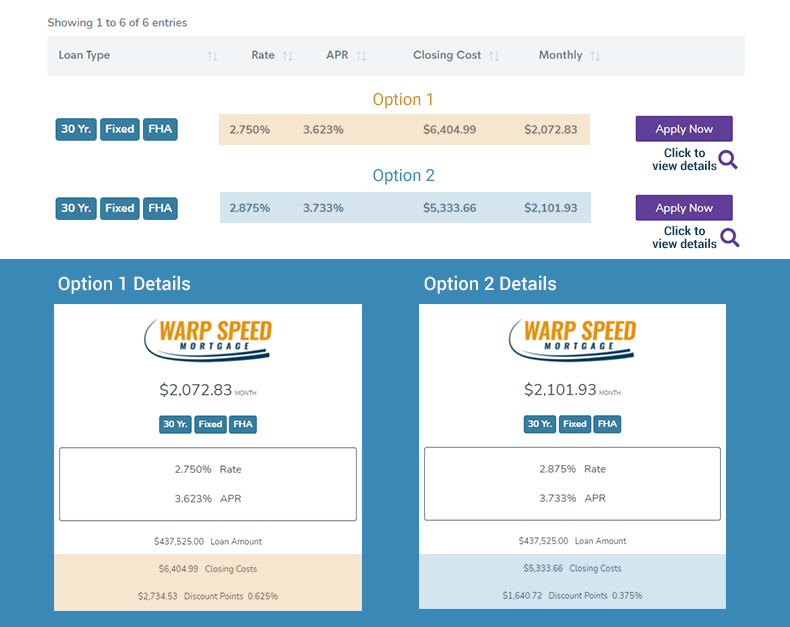

Discount points (or “points”) will lower your interest rate in exchange for an upfront fee paid at closing. When determining your rate offerings, discount points can already be included in the estimate, so it’s important to analyze the details of the program you’re being offered. You’ll want to make the determination if the savings from a lower interest rate will offset the increase in cash required at closing based on your own home financing goals.

Choosing your rate and loan program with Warp Speed Mortgage

When you View Today’s Rates at Warp Speed Mortgage, you’ll enter your loan and property details, your estimated credit score, and other important borrower information. Warp Speed Mortgage’s smart technology will take this data and provide a list of loan programs and interest rates paired with loan term options to choose from. Select the loan program and interest rate that best supports your home financing goals then complete the Warp Speed smart application to begin your digital online mortgage!

Why do my rate offerings show the same program with different interest rates?

The same loan programs are offered with different interest rates due to variations in the discount points included in the details of the loan. You can view the specific details for each loan program offering by clicking on the magnifying glass icon on the right side of the listing.

The Warp Speed Mortgage digital mortgage platform makes it easy to achieve your home financing goals from the comfort of your computer, smart phone, or tablet. To reach your home financing goals on your own time, get started here!